Project Details:

Duration - 4 months

Role - Design Lead, Strategist Lead

Awards:

Client Experience Transformation - First Place, Design & Innovation Global Award

Best ATM/self-service experience for financial institutions, Bank Customer Experience Summit

ATM Experience Design

Design-Driven ATM Experience Transformation Case Study

Summary

KeyBank's ATM group undertook a software upgrade using an off-the-shelf solution. However, upon deployment, clients faced challenges. To address these issues and enhance the client experience through this critical channel, KeyBank assembled a cross-functional team. This team united the ATM group with Key's in-house human-centered design and creative practice, Key Design Studio. As the lead strategist and designer for the project, I initiated a comprehensive process involving brainstorming solutions, creating prototypes, and conducting testing in branches with both clients and bankers. This process led to the introduction of new fascia plates and denomination screens. Impressively, within less than four months, these solutions were implemented across our nationwide ATM fleet, avoiding the time (6-12 months) and investment ($12MM) required to replace the existing hardware. The result was a remarkable 70% increase in our NPS (Net Promoter Score) and a notable 71% boost in our Customer Satisfaction Score.

Challenge Statement

Following a software update, Key Bank ATM users encountered increased difficulty while using the ATMs, leading to a decline in their satisfaction levels. This situation exposed a critical oversight in Key Bank’s decision-making process, where the user experience was not given the priority it deserved. This dissatisfaction was notably reflected in Key Bank’s ATM, NPS (Net Promoter Score), and CSAT (Customer Satisfaction) scores. Addressing this issue was imperative, but KeyBank faced the constraints of both time and budget. Replacing the entire ATM fleet with expensive new machines was financially unfeasible, and any delay in resolving the problem posed a risk of further business attrition. Recognizing the urgent need to place Key Bank’s clients at the core of the solution, Key Bank embarked on a mission to act swiftly. Concurrently, KeyBank’s Key Design Studio, a team specializing in Design Thinking, was expanding, presenting the perfect opportunity to deploy this valuable resource.

Design Thinking Process

Discovery and Analysis (Steps 1 and 2)

Incorporating a structured 5-step Design Thinking process, the Key Design Studio places particular emphasis on discovery and analysis (Step 1 and 2). During this critical phase, my team embarked on a journey to acquire profound client insights in order to gain a deeper understanding of their frustrations. This encompassed interviewing stakeholders to foster empathy for the challenges they faced, including resource limitations. We conducted a swift contextual inquiry, enabling us to explore ATM experiences both within and beyond our network. By engaging with our clients, we sought to better comprehend their behaviors and needs. Additionally, we invested significant effort in comprehending the entire domain to assess our competitive position. While we had a surface-level understanding of the issues impacting our metrics, our deeper exploration of our clients’ perspectives illuminated a wealth of insights.

Design Thinking Process

Ideation (Step 3)

The most remarkable revelation was the revelation that our clients didn’t crave elaborate features for their ATM experience. Instead, they yearned for simplicity. Our recent changes had inadvertently introduced confusion and complexity, further compounded by previously unacknowledged ATM-related concerns, notably revolving around security. Clients felt vulnerable when extracting cash from the machines, particularly in perceived unsafe locations. This in-depth understanding crystallized our path forward. We needed to resolve the bewildering transition caused by new software, where users were expected to shift to a touchscreen interface while physical buttons from the previous system still existed. Additionally, we had to address the cumbersome denomination experience, which had left clients feeling as though they were “solving an algebra problem” simply to access their cash.

Design Thinking Process

Prototyping and Testing (Steps 4 and 5)

Adopting this Design Thinking approach presented nuanced challenges within our organization, necessitating the breakdown of traditional barriers, especially during the ideation phase. Unconventionally, we brought stakeholders from multiple departments together. This diverged from the practices of a traditional organization like ours. To foster creativity, we created a low-stakes environment, exemplified by the “Worst-idea ever” exercise. The results were inspiring, as team members built upon each other’s concepts, rapidly converging on potential solutions. An idea that initially appeared as one of the “worst” — “Hide buttons” — surfaced and was deemed deceptively simple, yet promising.

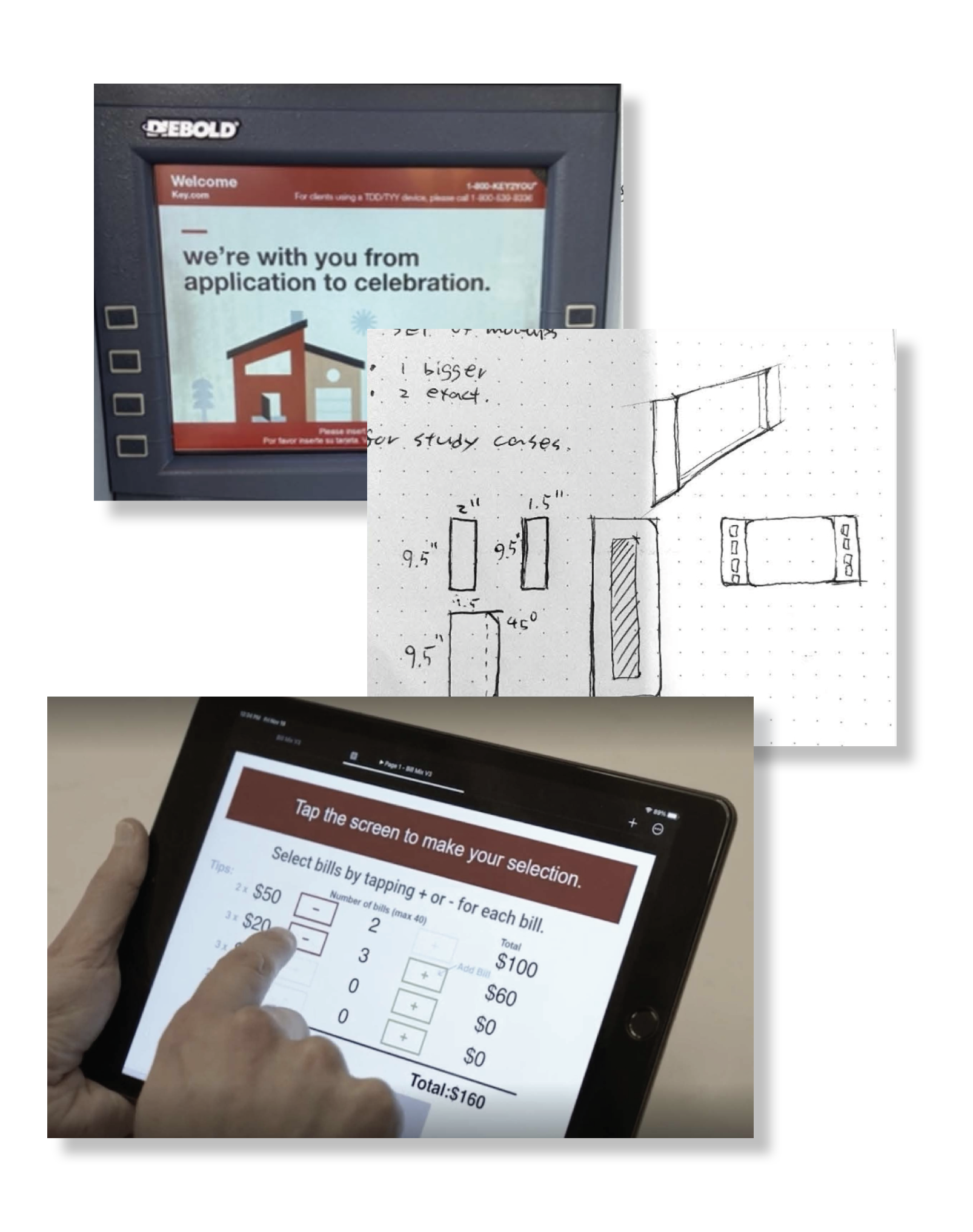

Design Doing

We explored the idea of “Hide Buttons” during the prototyping phase, along with other concepts aimed at simplifying the denomination screens. In our attempt to cover up the buttons, we considered using stickers, signs, and temporary solutions, although these approaches placed additional burdens on our already confused clients. To address the denomination screen issues, we initially engaged our software vendor to explore possibilities for simplification. Regrettably, they not only rejected our request for assistance but also declined to implement any solutions we might find, leading to some roadblocks in our progress.

However, we persisted, drawing from the extensive customer insights gathered during our discovery process. We swiftly devised testable solutions. For the touchscreen experience, we developed a solution that not only addressed the “Hide Buttons” issue but also tackled another concern for clients – safety. By creating plates that concealed hardware buttons and acted as rear-view mirrors, clients gained improved visibility behind them while using the ATM, introducing a feature unseen in the market before. Despite initial doubts about implementing a software change for bill selection, we decided to create a prototype to gain insights, even if an immediate fix seemed challenging.

Our branches served as ideal testing grounds for both prototypes, given their proximity to clients and their firsthand exposure to client complaints. For the denomination screens, where rolling out new software to the machines was not feasible, we employed a Figma prototype and iPad testing to simulate a user experience and gather feedback. This approach, although low-tech, proved both efficient and rapid.

Through these tests, we garnered invaluable insights. We discovered that the fascia plate prototype designed to “hide buttons” was well received by branch personnel and clients alike. Beyond accounting for machine variations, the physical product was successful. Visiting the branches also revealed that these plates were straightforward for branch staff to install, yielding cost savings by eliminating the need for installation crews across our nationwide network.

Similarly, the denomination test yielded promising results. By combining research and testing, we were able to understand our clients’ perspective better. This included the frustration of needing to calculate cash amounts while people lined up behind them, an issue we had not fully appreciated. Recognizing that providing totals would make a substantial difference, we shared our findings with our vendor, who had previously been inflexible about implementing software changes for denominations. However, upon seeing our proposal, backed by client feedback, they agreed to revise their software, recognizing that our findings offered a fresh perspective. This breakthrough might also benefit other banks in similar situations.

Results

Our efforts have yielded tangible and intangible results that have not only transformed our client experience but also garnered industry recognition. The impact of these straightforward solutions on our measurable results has been nothing short of remarkable. Our NPS Scores surged from 39 to 56 points, reflecting an impressive 70% increase, while our CES Scores rose from 51 to 72 points, marking a substantial 71% increase. Equally noteworthy are the immeasurable outcomes. Through this journey, we brought stakeholders together, fostering greater collaboration in our approach. We demonstrated that the most effective solutions emerge from such collaboration. This process also initiated a cultural shift towards Design Thinking within our organization, which continues to gain momentum. This shift in mindset is pivotal to the future of our organization, and it’s a source of immense pride for us. Notably, we’ve received accolades for our work, winning the Client Experience Transformation Award from Design & Innovation Global Award in September 2022 and the Best ATM/Self-Service Experience for Financial Institutions Award from Bank Customer Experience Summit in August 2022.